Overview

Market internals, also known as market breadth indicators, measure the health and participation of the overall market beyond what index prices alone can reveal. While the S&P 500 or Nasdaq might show a particular direction, market internals tell you whether that move is supported by broad participation across hundreds or thousands of stocks, or whether it is driven by just a handful of heavily-weighted names.

Professional traders, particularly those trading index futures like ES (E-mini S&P 500), NQ (E-mini Nasdaq), and YM (E-mini Dow), rely heavily on market internals to time entries and exits. A long entry in ES is more likely to succeed when market internals confirm buying pressure across the broad market. Conversely, shorting into strong internal readings increases the probability of getting stopped out.

The most commonly watched internals include NYSE TICK (instantaneous up-ticks minus down-ticks), ADD (cumulative advance/decline), and VOLD (up volume minus down volume). Each provides a different perspective on market participation, and together they paint a comprehensive picture of underlying market strength or weakness.

Key Benefits

- See beneath index prices to gauge true market participation

- Filter trades by market sentiment to improve win rates

- Identify extreme readings that often precede reversals

- Spot divergences between price and internals for early warning

NYSE TICK

The NYSE TICK is perhaps the most popular market internal for day traders. It measures the instantaneous number of NYSE stocks ticking up (last trade higher than previous) minus those ticking down (last trade lower than previous). The reading updates continuously throughout the trading day, providing real-time insight into whether the market is experiencing broad buying or selling pressure at any given moment.

Normal vs Extreme Readings

TICK readings typically range between -500 and +500 during normal market conditions. Readings above +800 indicate strong buying pressure, while readings below -800 indicate strong selling pressure. Extreme readings above +1000 or below -1000 are significant events that often mark intraday turning points.

When TICK prints extreme readings (+1200 or -1200, for example), it often indicates short-term exhaustion. A spike to +1200 during an uptrend might be the "blowoff" top of an intraday move. Conversely, a plunge to -1200 during a selloff might represent capitulation and a potential reversal point.

TICK Trading Strategies

Trend Filter: Only take long trades when TICK is predominantly positive (staying above zero). Only take shorts when TICK is predominantly negative. This simple filter aligns your trades with broad market flow.

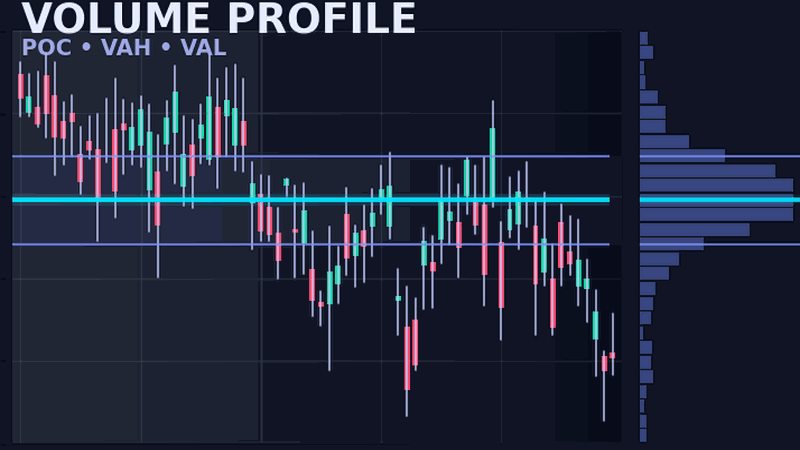

Extreme Fade: When TICK spikes to extreme readings (+1000 or -1000), look for reversal entries. These extremes are often unsustainable and precede mean reversion. Combine with Volume Profile levels for confluence.

TICK Divergence: When ES makes new highs but TICK fails to print new highs (or even starts declining), it warns that the rally lacks broad participation. The reverse applies for new lows in price with rising TICK readings.

Cumulative TICK

Cumulative TICK is a running total of all TICK readings throughout the day. A rising cumulative TICK line confirms a healthy uptrend with consistent buying pressure. A falling line during rising prices warns of a rally built on narrow participation that may not sustain.

ADD (Advance/Decline)

The ADD (Advance/Decline Difference) shows the cumulative number of advancing stocks minus declining stocks on the NYSE throughout the trading day. Unlike TICK which resets with each reading, ADD accumulates from the market open, providing a picture of net buying or selling pressure over the entire session.

Reading ADD Values

ADD starts at zero each day and moves up or down based on the running difference between advancers and decliners. A reading of +1500 means that throughout the day, there have been 1500 more advancing stocks than declining stocks (net). Values above +1000 indicate broad bullish participation; values below -1000 indicate broad bearish participation.

The trend of ADD matters more than absolute values. A steadily rising ADD line confirms that the uptrend has broad support. A sharply falling ADD line, even if still positive, warns that participation is deteriorating.

ADD Divergence

ADD divergence is a powerful early warning signal. If ES or SPY makes new session highs but ADD fails to make new highs, it indicates the rally is narrowing, driven by fewer stocks. This negative divergence often precedes pullbacks. Positive divergence (new price lows with ADD holding higher) suggests selling is exhausting and reversal may be near.

Professional Market Internals Dashboard

Real-time TICK, ADD, VOLD with extreme alerts, divergence detection, and customizable visualization.

VOLD (Up/Down Volume)

VOLD measures the cumulative volume in advancing stocks minus the volume in declining stocks. It answers the question: "Is more volume flowing into stocks that are rising or stocks that are falling?" This metric adds a volume dimension to breadth analysis, revealing not just how many stocks are moving but how much conviction (volume) is behind those moves.

Interpreting VOLD

Large positive VOLD readings indicate strong volume flowing into advancing stocks, confirming bullish moves. Large negative readings indicate heavy volume in declining stocks, confirming bearish moves. The magnitude of VOLD provides insight into the intensity of the move.

Compare VOLD to ADD for a complete picture. If ADD is positive (more stocks advancing) but VOLD is flat or negative (more volume in decliners), it suggests the advancing stocks are small-cap or low-volume names while significant volume is actually flowing into declining stocks. This divergence warns of underlying weakness.

Volume Confirmation

Use VOLD to confirm breakouts. A breakout in ES accompanied by surging VOLD indicates institutional participation and increases the probability of continuation. A breakout with flat or declining VOLD suggests lack of conviction and higher probability of failure.

Other Breadth Indicators

TRIN (Arms Index)

The TRIN (Trading Index), also known as the Arms Index, combines advance/decline data with up/down volume into a single reading. The formula is: (Advancing Issues / Declining Issues) / (Advancing Volume / Declining Volume). Readings below 1.0 are bullish (more volume in advancers), readings above 1.0 are bearish (more volume in decliners). Extreme readings above 2.0 or below 0.5 often mark reversal points.

New Highs/New Lows

The number of stocks making new 52-week highs versus new 52-week lows provides longer-term context. A healthy bull market sees expanding new highs and contracting new lows. When the market makes new highs but the number of individual stocks making new highs shrinks, it warns of narrowing leadership and potential distribution.

Sector Internals

Some traders track internals for specific sectors like technology (using Nasdaq TICK and ADD) or financials. This provides sector-specific context that can be more relevant than broad NYSE internals when trading sector-focused products.

NinjaScript Implementation

The following code demonstrates how to load market internal data into a custom indicator in NinjaScript. This example shows loading TICK data as a secondary data series and calculating cumulative values.

namespace NinjaTrader.NinjaScript.Indicators

{

public class MarketInternalsPanel : Indicator

{

private double cumulativeTick;

protected override void OnStateChange()

{

if (State == State.SetDefaults)

{

Description = "Market Internals Dashboard";

Name = "MarketInternalsPanel";

Calculate = Calculate.OnBarClose;

IsOverlay = false;

AddPlot(Brushes.Cyan, "TICK");

AddPlot(Brushes.Orange, "CumulativeTICK");

}

else if (State == State.Configure)

{

// Add TICK as secondary data series

AddDataSeries("^TICK", BarsPeriodType.Minute, 1);

}

}

protected override void OnBarUpdate()

{

if (BarsInProgress == 0) return; // Wait for TICK data

if (BarsInProgress == 1) // TICK data series

{

double tickValue = Closes[1][0];

Values[0][0] = tickValue;

// Accumulate TICK readings

cumulativeTick += tickValue;

Values[1][0] = cumulativeTick;

// Color based on extreme readings

if (tickValue > 1000)

PlotBrushes[0][0] = Brushes.Lime;

else if (tickValue < -1000)

PlotBrushes[0][0] = Brushes.Red;

}

}

}

}Note: The exact symbol for TICK varies by data provider (^TICK, $TICK, $TICK.X, etc.). Check your data provider's documentation for the correct symbol format.

Settings and Configuration

Configuring market internals effectively requires understanding both the data and your trading style.

Data Symbols

Common symbol formats vary by provider: NYSE TICK may be $TICK, ^TICK, or $TICK.X; ADD may be $ADD, ^ADD, or $ADVD; VOLD may be $VOLD, ^VOLD, or $UVOL-$DVOL. Consult your data provider's symbol guide.

Extreme Thresholds

Configure alert levels for extreme readings. Common TICK thresholds are +/-800 for significant readings and +/-1000 for extreme readings. These may need adjustment based on market conditions; during high-volatility periods, extremes become more common.

Display Options

Choose between raw values, cumulative values, or smoothed averages (like 14-period SMA of TICK). Some traders prefer a histogram format showing current TICK versus a rolling average to identify relative strength or weakness.

Multi-Panel Layout

Many traders display TICK, ADD, and VOLD in separate panels below their main price chart. This provides a complete breadth picture at a glance. Color-coding panels based on bullish/bearish thresholds enables rapid visual assessment.

Frequently Asked Questions

What is the NYSE TICK indicator?

NYSE TICK measures the number of NYSE stocks ticking up minus those ticking down at any moment. Extreme readings above +1000 or below -1000 indicate strong buying or selling pressure across the broad market. It helps traders gauge intraday market sentiment.

What is the ADD (Advance/Decline) indicator?

ADD measures the cumulative difference between advancing and declining stocks on the NYSE. Rising ADD confirms uptrends with broad participation. Falling ADD during rising prices warns of narrow rallies. It shows market breadth and participation.

What is VOLD and how is it used?

VOLD (Up Volume minus Down Volume) measures the volume in advancing stocks minus volume in declining stocks. Positive VOLD indicates more volume flowing into rising stocks. Large divergences between VOLD and price suggest potential reversals.

How do I interpret extreme TICK readings?

TICK readings above +1000 indicate strong buying pressure, often unsustainable and may precede pullbacks. Readings below -1000 indicate panic selling and potential capitulation. Sustained readings in one direction confirm trend strength.

Why use market internals for trading?

Market internals reveal what's happening beneath the surface of index prices. A rising S&P 500 with deteriorating internals warns of weak rallies. Strong internals confirm healthy trends. They provide early warning of trend changes before price reverses.

What data feed do I need for market internals?

Market internals require real-time data feeds that include $TICK, $ADD, $VOLD, and other breadth symbols. Most professional data providers like Kinetick, CQG, and Rithmic provide these symbols. Check your data provider's symbol list.