Overview

A liquidity sweep occurs when price moves beyond a significant price level to trigger clustered stop-loss orders, then reverses. This phenomenon, central to Smart Money Concepts (SMC) and Inner Circle Trader (ICT) methodology, reveals how institutional traders manipulate price to access the liquidity they need to fill large orders.

The core premise is simple: large institutional orders require counterparties. When a hedge fund wants to buy millions of dollars worth of an asset, they need sellers. The easiest way to find sellers is to trigger stop-loss orders from existing long positions. By pushing price below obvious support levels, institutions trigger a cascade of sell stops, which they then absorb as the counterparty to their buy orders.

Understanding liquidity sweeps transforms how traders view stop hunts. Rather than being random market noise, these movements become predictable patterns that can be traded profitably. Traders who recognize sweep setups can avoid being stopped out at the worst possible moment and instead position themselves alongside institutional order flow.

Key Benefits

- Identify high-probability reversal zones before they occur

- Avoid being stopped out by institutional manipulation

- Trade with institutional order flow rather than against it

Key Concepts

Liquidity Pools

Liquidity pools are areas on the chart where stop-loss orders cluster. These form naturally at obvious price levels because traders tend to place stops at similar locations: just above swing highs, just below swing lows, above equal highs (double tops), and below equal lows (double bottoms). The more obvious the level, the more stops accumulate there.

Institutions track these liquidity pools because they represent available order flow. When an institution needs to build a position, they know exactly where to find willing sellers (below support) or buyers (above resistance). The sweep of these pools is not random but deliberate.

Buy-Side Liquidity

Buy-side liquidity exists above resistance levels and swing highs. It consists of two main components: stop-loss orders from short sellers protecting their positions, and buy-stop orders from breakout traders waiting to enter long positions when resistance breaks.

When institutions want to sell a large position, they need buyers. By pushing price above resistance, they trigger all this buy-side liquidity. Short sellers covering and breakout buyers entering create the buying pressure that institutions can sell into. After the liquidity is absorbed, price reverses sharply downward.

Visual clues for buy-side liquidity include equal highs (where price has topped at the same level multiple times), obvious resistance zones, and round numbers. The more times price has respected a level, the more liquidity accumulates above it.

Sell-Side Liquidity

Sell-side liquidity exists below support levels and swing lows. It comprises stop-loss orders from long traders protecting profits or limiting losses, and sell-stop orders from breakdown traders waiting to short when support fails.

When institutions want to accumulate a large long position, they need sellers. By pushing price below support, they trigger this sell-side liquidity. Long traders stopping out and breakdown traders entering short create the selling pressure that institutions can buy. After absorbing this liquidity, price typically rallies.

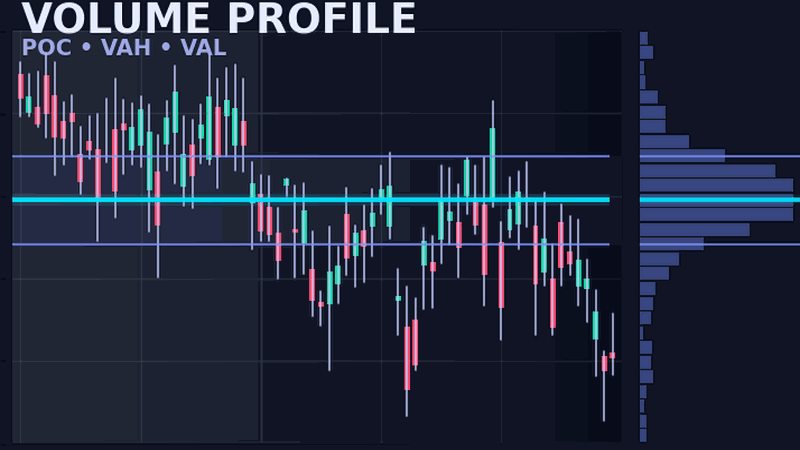

Visual clues for sell-side liquidity include equal lows (where price has bottomed at the same level multiple times), obvious support zones, and round numbers. Sweeps often occur at Volume Profile low volume nodes where price can move quickly through thin order flow.

Market Structure Shift (MSS)

Market Structure Shift is the confirmation signal that a liquidity sweep is complete and price direction is changing. It occurs when price breaks a recent swing point in the direction opposite to the sweep.

For example: After a sell-side sweep (price sweeps below a swing low), bullish MSS occurs when price breaks above the most recent lower high. This break confirms that institutions have finished accumulating and are now allowing price to rise. Similarly, after a buy-side sweep, bearish MSS is confirmed when price breaks below the most recent higher low.

The MSS is critical for timing entries. Trading the sweep itself is risky because you cannot know if the sweep is complete. Waiting for MSS provides confirmation that institutional accumulation or distribution has finished and the new trend is beginning.

Professional Liquidity Detection

Auto-identify liquidity pools, real-time sweep alerts, and market structure shift confirmation with institutional-grade precision.

Detection Methodology

Detecting liquidity sweeps follows a systematic process that combines structure analysis with price action confirmation. Combine with Order Flow Delta to see absorption at sweep levels.

Step-by-Step Detection

- Identify Swing Structure: Mark recent swing highs and swing lows on your timeframe

- Mark Liquidity Pools: Highlight areas above highs (buy-side) and below lows (sell-side) where stops likely cluster

- Watch for Price Sweep: Monitor for price to push beyond these liquidity levels

- Identify Rejection: Look for rejection candles showing long wicks that sweep into liquidity then close back inside the range

- Wait for MSS: After the sweep, watch for a break of recent structure in the opposite direction

- Enter on Confirmation: Enter in the direction of the MSS with your stop placed beyond the sweep wick

The most reliable sweeps occur when multiple liquidity levels converge. For example, a swing low that coincides with equal lows and a round number will have significantly more liquidity than an isolated swing point. These confluent levels produce the most dramatic reversals.

How to Trade

Sweep Entry Strategy

The optimal entry strategy waits for three confirmations: first, the sweep must occur with price pushing beyond the liquidity level. Second, a rejection candle must form showing a long wick into the liquidity zone with the close back inside the previous range. Third, a Market Structure Shift must confirm the direction change.

Enter your trade after the MSS candle closes. For a bullish setup (after sell-side sweep), enter long after the candle that breaks above the recent lower high closes. For a bearish setup (after buy-side sweep), enter short after the candle that breaks below the recent higher low closes.

Stop Placement

Place your stop-loss beyond the sweep wick. This level represents the true invalidation of the setup. If price returns to sweep that level again and breaks through, the original sweep was not the completion point, and you want to be out of the trade.

For a bullish setup after a sell-side sweep, place your stop a few ticks below the sweep low. For a bearish setup after a buy-side sweep, place your stop a few ticks above the sweep high. This placement provides a clear invalidation level while keeping risk defined.

Take Profit Targets

Primary targets for sweep trades are the swing highs or lows that price came from before the sweep. Secondary targets are the next liquidity zones in the direction of your trade. After a sell-side sweep and bullish MSS, target the recent swing high first, then the buy-side liquidity above it.

Many traders scale out of positions, taking partial profits at the first swing point and letting the remainder run to the opposite liquidity zone. This approach locks in profits while allowing participation in larger moves when institutions continue in that direction.

Risk Management

Even with proper MSS confirmation, not every sweep trade will work. Sometimes the MSS fails and price returns to sweep the liquidity level again. In these cases, your stop beyond the sweep protects you. If stopped out, you may see a second sweep and MSS that offers a new entry opportunity.

NinjaScript Implementation

The following NinjaScript code provides a conceptual framework for liquidity sweep detection. Production implementations include swing strength filtering and MSS confirmation logic.

namespace NinjaTrader.NinjaScript.Indicators

{

public class LiquiditySweepConcept : Indicator

{

private double swingHighPrice;

private double swingLowPrice;

protected override void OnStateChange()

{

if (State == State.SetDefaults)

{

Description = "Liquidity Sweep Concept";

Name = "LiquiditySweepConcept";

IsOverlay = true;

}

}

protected override void OnBarUpdate()

{

if (CurrentBar < 5) return;

// Identify swing high (simplified: higher than neighbors)

bool isSwingHigh = High[2] > High[3] && High[2] > High[1];

if (isSwingHigh) swingHighPrice = High[2];

// Identify swing low

bool isSwingLow = Low[2] < Low[3] && Low[2] < Low[1];

if (isSwingLow) swingLowPrice = Low[2];

// Detect buy-side sweep (price exceeds swing high then closes back below)

bool buySideSweep = High[0] > swingHighPrice && Close[0] < swingHighPrice;

// Detect sell-side sweep

bool sellSideSweep = Low[0] < swingLowPrice && Close[0] > swingLowPrice;

// Mark sweep events for further analysis

}

}

}Note: Production implementations include swing strength filtering, multiple timeframe analysis, and Market Structure Shift confirmation logic for reliable signals.

Settings

Liquidity sweep indicators typically offer several configuration options to customize detection sensitivity and display preferences.

- Swing Lookback: Number of bars to identify swing points (default 5-10 bars)

- Sweep Threshold: How far price must exceed the level to qualify as a sweep (in ticks)

- MSS Detection: Enable or disable automatic Market Structure Shift marking

- Liquidity Zone Display: Show or hide projected liquidity pools on the chart

- Alert Types: Configure notifications for sweep detection, MSS confirmation, or both

Frequently Asked Questions

What is a liquidity sweep?

A liquidity sweep occurs when price moves beyond a significant level (swing high or low) to trigger clustered stop orders, then reverses. Institutions use sweeps to fill large orders by accessing the liquidity from triggered stops.

How do institutions create stop hunts?

Institutions move price through obvious support or resistance levels where retail traders place stops. This triggers a cascade of stop orders that institutions use as counterparty liquidity to fill their own positions in the opposite direction.

How do I identify liquidity pools?

Liquidity pools form at obvious price levels where traders cluster stops: above swing highs (buy-side liquidity), below swing lows (sell-side liquidity), above equal highs, and below equal lows. The more obvious the level, the more liquidity present.

What is buy-side vs sell-side liquidity?

Buy-side liquidity sits above resistance (stop losses from shorts, buy stops from breakout traders). Sell-side liquidity sits below support (stop losses from longs, sell stops from breakdown traders). Sweeping buy-side provides selling liquidity; sweeping sell-side provides buying liquidity.

How do I trade liquidity sweeps?

Wait for price to sweep a liquidity level and show rejection (long wick, close back inside range). Then wait for Market Structure Shift (MSS) confirmation - a break of recent structure in the opposite direction. Enter in the MSS direction with stop beyond the sweep.

What is Market Structure Shift (MSS)?

Market Structure Shift is a break of recent price structure that confirms the sweep is complete and direction is changing. After a sell-side sweep (bearish grab), bullish MSS is a break above the most recent lower high. This confirms institutions are now buying.