Overview

Pivot points are one of the oldest and most widely used technical analysis tools, originating from the trading floors of commodity exchanges. Floor traders needed a quick way to calculate potential support and resistance levels before the market opened, using only the previous session's high, low, and close. The resulting pivot levels became self-fulfilling prophecies as countless traders watched the same numbers, making them even more significant.

Today, pivot points remain relevant because they are calculated the same way by traders worldwide, creating genuine confluence where orders cluster. When price approaches a pivot level, the accumulated orders from traders using pivots for entries, stops, and targets create actual market reactions at these mathematically-derived levels.

Advanced pivot point implementations offer multiple calculation methods (Standard, Fibonacci, Camarilla, Woodie's, DeMark's), each with different formulas that produce different levels. Additionally, pivots can be calculated from different timeframes: daily pivots provide intraday levels, weekly pivots provide swing trading levels, and monthly pivots mark major support and resistance zones. Combining multiple methods and timeframes reveals where levels cluster, creating high-probability reaction zones.

Key Benefits

- Objective, universally-calculated support and resistance levels

- Multiple calculation methods for different trading styles

- Known in advance - plan trades before the session opens

- Daily, weekly, and monthly timeframes for multi-level analysis

Standard Pivot Points

Standard pivot points (also called Floor Trader Pivots or Classic Pivots) are the most widely used pivot method. The central pivot point (PP) is calculated as the average of the previous period's high, low, and close. Support and resistance levels are then derived from this central pivot.

Calculation Formulas

PP = (High + Low + Close) / 3 R1 = (2 x PP) - Low S1 = (2 x PP) - High R2 = PP + (High - Low) S2 = PP - (High - Low) R3 = High + 2 x (PP - Low) S3 = Low - 2 x (High - PP)

Trading Standard Pivots

The central pivot (PP) acts as the primary sentiment indicator for the session. If price is trading above PP, bias is bullish; below PP, bias is bearish. S1 and R1 are the first targets and typical intraday support/resistance. S2/R2 represent extended moves. S3/R3 are extreme levels that typically only get reached on high-volatility days.

A common strategy is to buy at S1 with a stop below S2 and target PP or R1. Conversely, sell at R1 with a stop above R2 and target PP or S1. This mean-reversion approach works well in ranging markets. In trending markets, pivots serve better as targets than entry levels.

Fibonacci Pivot Points

Fibonacci pivot points apply Fibonacci retracement and extension ratios to the previous period's range. The central pivot is calculated identically to standard pivots, but support and resistance levels use Fibonacci multipliers of the range.

Calculation Formulas

PP = (High + Low + Close) / 3 Range = High - Low R1 = PP + (0.382 x Range) S1 = PP - (0.382 x Range) R2 = PP + (0.618 x Range) S2 = PP - (0.618 x Range) R3 = PP + (1.000 x Range) S3 = PP - (1.000 x Range)

Trading Fibonacci Pivots

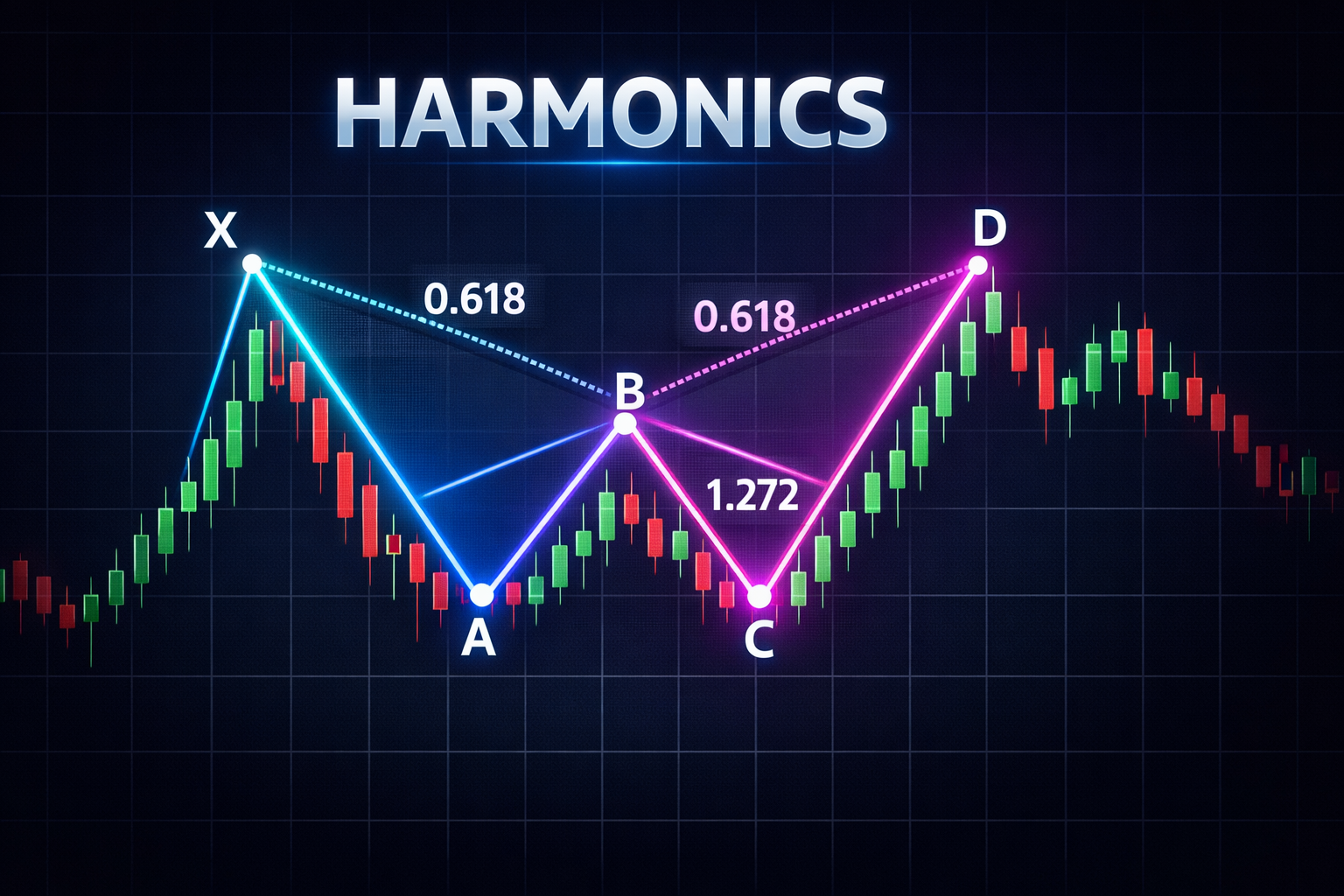

Fibonacci pivots work well with traders who already use Fibonacci retracement in their analysis, providing natural confluence with other Fib-based tools. The 38.2% and 61.8% levels often align with harmonic pattern completion zones, creating powerful combination setups.

Camarilla Pivot Points

Camarilla pivots, developed by Nick Scott in 1989, produce tighter levels than standard pivots, making them popular among day traders seeking frequent mean-reversion opportunities. The levels are based on the premise that price tends to revert to the mean within a range defined by yesterday's range.

Calculation Formulas

Range = High - Low R4 = Close + (Range x 1.1/2) R3 = Close + (Range x 1.1/4) R2 = Close + (Range x 1.1/6) R1 = Close + (Range x 1.1/12) S1 = Close - (Range x 1.1/12) S2 = Close - (Range x 1.1/6) S3 = Close - (Range x 1.1/4) S4 = Close - (Range x 1.1/2)

Trading Camarilla Pivots

The S3/R3 levels are the key trading levels for mean reversion. When price reaches R3, look to sell with a stop above R4 and target S1 or S2. When price reaches S3, look to buy with a stop below S4 and target R1 or R2. The S4/R4 levels serve as breakout confirmation: a close beyond these levels suggests a trending day rather than a mean-reversion day.

Professional Pivot Suite

All pivot methods, multi-timeframe display, level confluence detection, and price proximity alerts.

Woodie's Pivot Points

Woodie's pivot points, developed by Ken Wood, place greater emphasis on the closing price by using it twice in the central pivot calculation. This makes the pivot levels more responsive to where price settled at the end of the session rather than the full range.

Calculation Formulas

PP = (High + Low + 2 x Close) / 4 R1 = (2 x PP) - Low S1 = (2 x PP) - High R2 = PP + (High - Low) S2 = PP - (High - Low)

Trading Woodie's Pivots

Because Woodie's pivots weight the close heavily, the central pivot tends to be closer to where price ended the previous session. This can make the pivot more relevant as a sentiment indicator for the current session, especially if the previous session had a strong directional close.

DeMark's Pivot Points

DeMark's pivot points, developed by Tom DeMark, are unique in that the calculation changes based on the relationship between the open and close of the previous period. This creates conditional logic that attempts to account for the market's internal structure.

Calculation Formulas

If Close < Open: X = High + (2 x Low) + Close If Close > Open: X = (2 x High) + Low + Close If Close = Open: X = High + Low + (2 x Close) PP = X / 4 R1 = X / 2 - Low S1 = X / 2 - High

Trading DeMark's Pivots

DeMark's method produces only one support and one resistance level, making it simpler but less comprehensive than other methods. The conditional calculation aims to provide levels more aligned with the previous session's character. DeMark pivots are often used in conjunction with other DeMark indicators like TD Sequential.

Pivot Timeframes

Daily Pivots

Daily pivots are calculated from the previous day's high, low, and close. They provide intraday support and resistance levels, making them essential for day traders. For 24-hour markets like futures, ensure your pivot calculation uses the appropriate session definition (RTH, globex, or combined).

Weekly Pivots

Weekly pivots use the previous week's high, low, and close (Friday close for most markets). These levels provide key support and resistance for swing traders operating over multiple days. Weekly pivots often mark significant levels that price reacts to throughout the week.

Monthly Pivots

Monthly pivots use the previous month's data and provide major support and resistance levels for position traders and longer-term analysis. These levels are watched by institutional traders and often mark significant turning points.

Multi-Timeframe Confluence

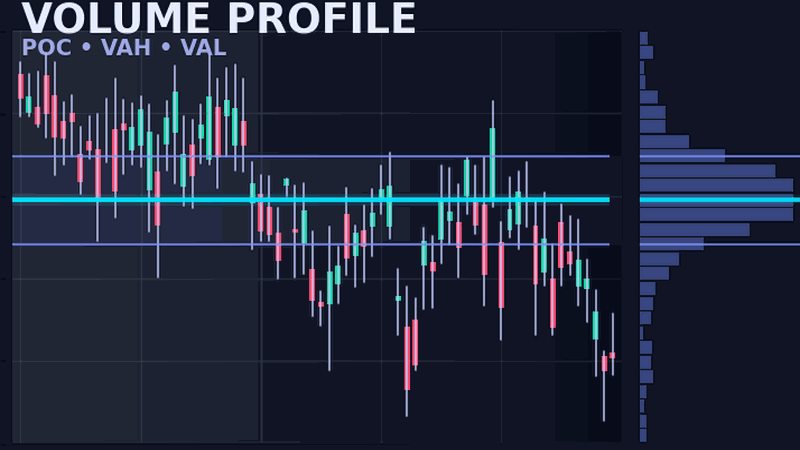

When daily, weekly, and monthly pivot levels cluster near each other, the confluence creates exceptionally strong support or resistance. For example, if daily R1 aligns with weekly PP and monthly S1 all within a few ticks, that zone becomes a high-probability reaction area.

NinjaScript Implementation

The following code demonstrates the standard pivot point calculation in NinjaScript. This example shows how to calculate daily pivots and plot the levels on your chart.

namespace NinjaTrader.NinjaScript.Indicators

{

public class PivotPoints : Indicator

{

private double pp, r1, r2, r3, s1, s2, s3;

private double priorHigh, priorLow, priorClose;

protected override void OnStateChange()

{

if (State == State.SetDefaults)

{

Description = "Standard Pivot Points";

Name = "PivotPoints";

IsOverlay = true;

AddPlot(Brushes.Yellow, "PP");

AddPlot(Brushes.Green, "R1");

AddPlot(Brushes.Green, "R2");

AddPlot(Brushes.Green, "R3");

AddPlot(Brushes.Red, "S1");

AddPlot(Brushes.Red, "S2");

AddPlot(Brushes.Red, "S3");

}

}

protected override void OnBarUpdate()

{

if (Bars.IsFirstBarOfSession)

{

// Get prior session data

priorHigh = PriorDayOHLC().PriorHigh[0];

priorLow = PriorDayOHLC().PriorLow[0];

priorClose = PriorDayOHLC().PriorClose[0];

// Calculate standard pivot points

pp = (priorHigh + priorLow + priorClose) / 3;

r1 = (2 * pp) - priorLow;

s1 = (2 * pp) - priorHigh;

r2 = pp + (priorHigh - priorLow);

s2 = pp - (priorHigh - priorLow);

r3 = priorHigh + 2 * (pp - priorLow);

s3 = priorLow - 2 * (priorHigh - pp);

}

// Plot levels

Values[0][0] = pp;

Values[1][0] = r1;

Values[2][0] = r2;

Values[3][0] = r3;

Values[4][0] = s1;

Values[5][0] = s2;

Values[6][0] = s3;

}

}

}To implement other pivot methods, modify the calculation formulas accordingly. For weekly or monthly pivots, use PriorWeekOHLC() or calculate from monthly data using custom session management.

Settings and Configuration

Configuring pivot points correctly ensures the levels align with how you and other traders calculate them.

Pivot Method

Choose between Standard, Fibonacci, Camarilla, Woodie's, or DeMark's. Standard is most widely watched. Camarilla is popular for mean reversion day trading. Fibonacci aligns with Fib-based analysis. Test multiple methods on your market to see which produces the most reliable reactions.

Calculation Period

Select daily, weekly, or monthly. Day traders primarily use daily. Swing traders benefit from weekly. Position traders focus on monthly. Displaying multiple timeframes simultaneously reveals confluence zones.

Session Definition

For futures and 24-hour markets, define which session the pivots calculate from. Options typically include RTH only (regular trading hours), ETH only (electronic/globex hours), or combined. RTH pivots are most common as they align with the majority of institutional trading.

Level Display

Configure which levels to show. Displaying all levels (PP, R1-R3, S1-S3) can clutter charts on shorter timeframes. Some traders prefer showing only PP, R1, S1 for cleaner visualization, adding R2/S2 only on high-volatility days.

Frequently Asked Questions

What are pivot points in trading?

Pivot points are calculated support and resistance levels based on the previous period's high, low, and close. They provide objective price levels where price may reverse or break out, widely used by floor traders and institutions as reference points.

How are Standard pivot points calculated?

Standard pivot point (PP) = (High + Low + Close) / 3. Support and resistance levels are calculated as: R1 = 2*PP - Low, S1 = 2*PP - High, R2 = PP + (High - Low), S2 = PP - (High - Low), and so on for R3/S3.

What is the difference between pivot point methods?

Standard pivots use simple averaging. Fibonacci pivots apply Fib ratios to the range. Camarilla creates tighter levels focused on mean reversion. Woodie's weights the close more heavily. DeMark's adjusts based on open vs close relationship.

Which pivot point method is best?

No single method is universally best. Standard pivots are most widely watched and often provide the best support/resistance. Fibonacci pivots work well in trending markets. Camarilla excels for mean reversion day trading. Test multiple methods on your market.

Should I use daily, weekly, or monthly pivots?

Day traders primarily use daily pivots for intraday levels. Weekly pivots provide key levels for swing traders. Monthly pivots mark major support/resistance for position traders. Using multiple timeframes shows where levels cluster for stronger confluence.

How do I trade pivot points?

Trade pivots by watching for price reactions at levels. Buy at support pivots (S1, S2) with bullish confirmation. Sell at resistance pivots (R1, R2) with bearish confirmation. The central pivot (PP) often acts as a key level for trend determination.