Why Choosing the Right Indicators Matters

In the competitive world of futures and equities trading, the indicators you choose can mean the difference between consistent profits and frustrating losses. NinjaTrader 8 has established itself as the platform of choice for serious traders, offering unparalleled flexibility for custom indicator development and third-party integrations. But with thousands of indicators available, how do you separate signal from noise?

The best indicators do more than paint lines on a chart. They reveal market structure, highlight institutional activity, and provide actionable insights that align with your trading style. Whether you are a scalper hunting for quick momentum plays or a swing trader positioning for multi-day moves, the right indicator suite amplifies your edge.

In this comprehensive guide, we evaluate the top 10 NinjaTrader indicators for 2026. We have selected these tools based on real-world performance, trader feedback, and their ability to provide genuine market insights rather than lagging information. From volume-based analysis that reveals where institutions are positioning to advanced pattern recognition that identifies high-probability setups, these indicators represent the best available tools for NinjaTrader 8 traders.

By the end of this guide, you will understand which indicators suit your trading style, how to combine them effectively, and where to access both free and professional versions. Let us dive into the tools that will define successful trading in 2026.

How We Evaluated These Indicators

We assessed each indicator against five core criteria that matter most to active traders. Understanding these criteria helps you evaluate not just our picks but any indicator you encounter in the wild.

Evaluation Criteria

- Ease of Use: How quickly can a trader learn to interpret the indicator? Does it require extensive configuration or work out of the box? The best indicators provide immediate value while offering depth for advanced users.

- Accuracy: Does the indicator provide reliable signals? We look for tools with high signal-to-noise ratios that minimize false positives and whipsaws. Lagging indicators score lower than leading or coincident tools.

- Customization: Can the indicator adapt to different markets, timeframes, and trading styles? Rigid indicators that only work in specific conditions have limited utility.

- NinjaTrader 8 Compatibility: Is the indicator fully optimized for NT8? We verify proper state management, efficient OnBarUpdate handling, and compatibility with tick replay and market replay features.

- Value for Money: For premium indicators, does the price justify the functionality? We also evaluate free alternatives and built-in options where available.

Each indicator in our list receives ratings for these criteria, helping you match tools to your specific needs and budget. Now let us examine the ten indicators that earned their place on this list.

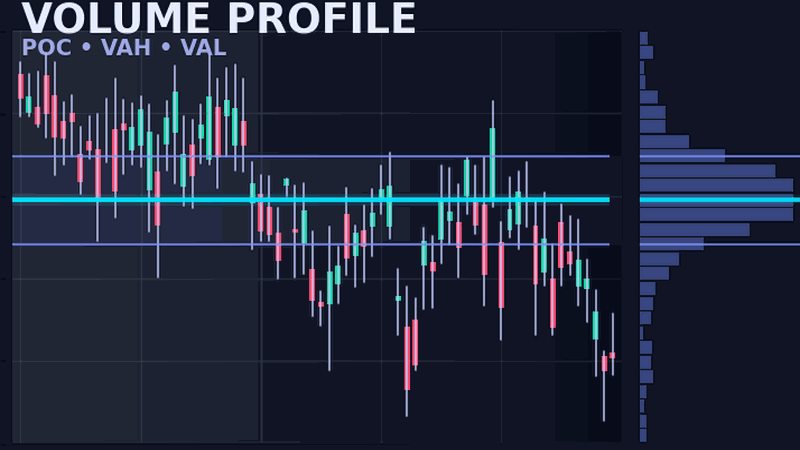

1. Volume Profile

Best for: Identifying institutional support and resistance levels

Volume Profile has become the cornerstone indicator for professional traders who want to understand where significant buying and selling activity occurs. Unlike time-based volume bars, Volume Profile displays volume at each price level, revealing the Point of Control (POC), Value Area, and High/Low Volume Nodes. These levels act as magnets and barriers for price, providing objective support and resistance zones based on actual market participation.

Day traders use session profiles to identify intraday pivot points, while swing traders analyze composite profiles across multiple weeks to find longer-term accumulation and distribution zones. The indicator excels in futures markets like ES, NQ, and CL, where volume data is accurate and meaningful. Combined with Market Profile concepts from the Chicago Board of Trade, Volume Profile provides the closest thing to an institutional view of the market available to retail traders.

- Ease of Use: Moderate - requires understanding of auction theory concepts

- Accuracy: High - based on actual traded volume, not derived calculations

- Customization: Excellent - session, composite, and fixed-range options

Read our complete Volume Profile guide for setup instructions, trading strategies, and NinjaScript implementation details.

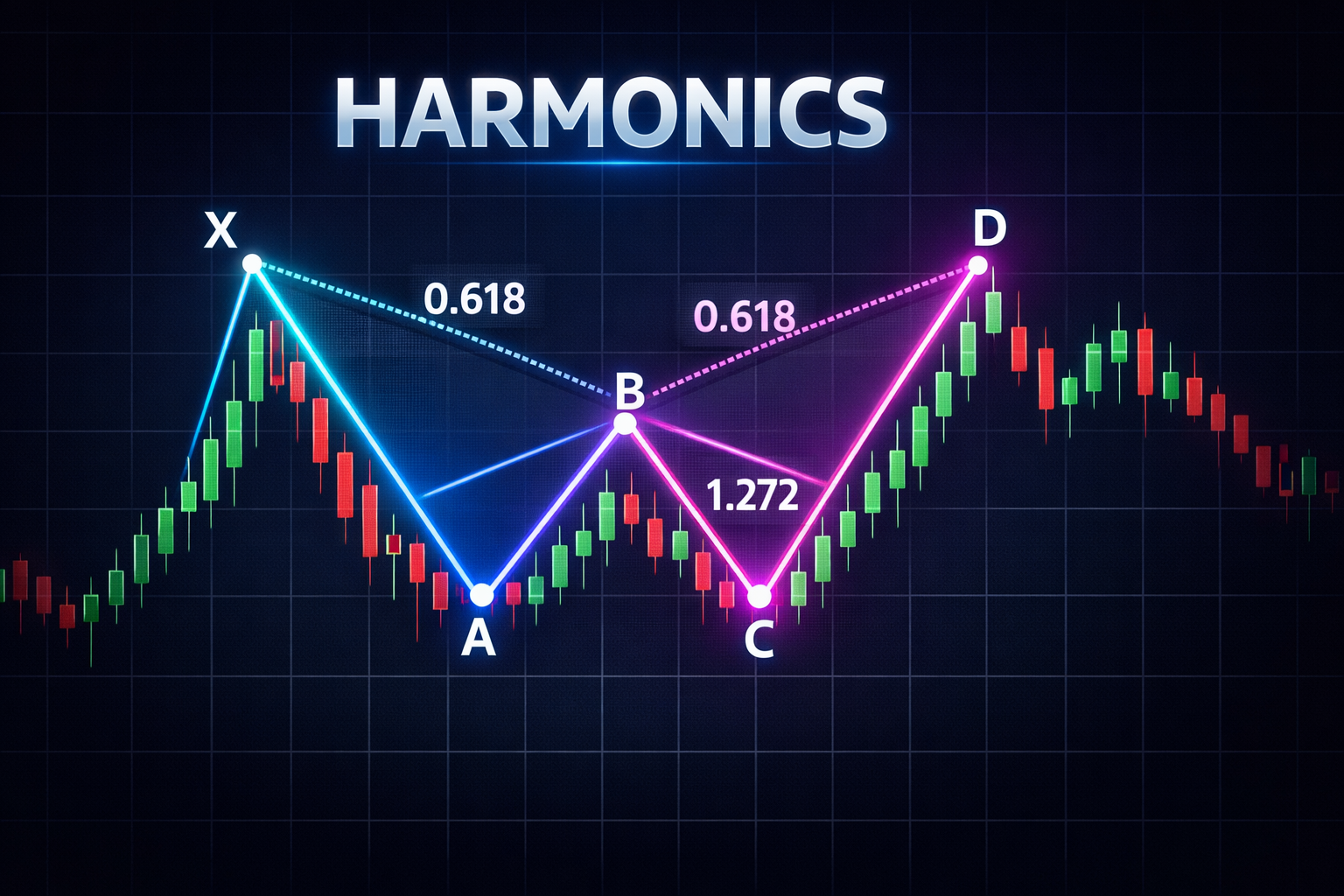

2. Harmonic Patterns

Best for: High-probability reversal entries with defined risk

Harmonic patterns combine Fibonacci mathematics with geometric price structures to identify potential reversal zones before they occur. Patterns like the Gartley, Butterfly, Bat, and Crab each have specific Fibonacci ratios that define their structure, making them one of the most objective pattern-based trading methodologies available. When a harmonic pattern completes at the Potential Reversal Zone (PRZ), traders have clearly defined entry points, stop losses, and profit targets.

The power of harmonic patterns lies in their ability to identify exhaustion points in trending moves. Unlike trend-following indicators that keep you in a trade until momentum reverses, harmonic patterns anticipate where reversals are likely to occur. This makes them particularly valuable for traders who prefer mean-reversion strategies or want to catch the turn at market extremes.

- Ease of Use: Advanced - requires study of pattern ratios and completion zones

- Accuracy: High when patterns complete correctly at PRZ

- Customization: Moderate - ratio tolerances and pattern types can be adjusted

Explore our Harmonic Patterns indicator guide for detailed ratio tables, pattern identification, and trading strategies.

3. Liquidity Sweep

Best for: Catching institutional stop hunts and false breakouts

Liquidity Sweep indicators detect when price makes a brief excursion beyond obvious support or resistance levels to trigger stop-loss orders before reversing. This Smart Money Concept (SMC) tool identifies buy-side liquidity grabs above swing highs and sell-side liquidity grabs below swing lows. Understanding liquidity sweeps transforms frustrating stop-outs into high-probability entry signals.

Institutional traders need liquidity to fill large orders without excessive slippage. Retail stop-loss clusters provide that liquidity. When you see price spike through a level only to immediately reverse, you are witnessing a liquidity sweep. Indicators that identify these events in real-time give you the opportunity to enter with institutional flow rather than against it.

- Ease of Use: Easy - visual alerts when sweeps occur

- Accuracy: Good - not all sweeps lead to reversals, requires context

- Customization: Good - sweep depth and lookback period adjustable

Read our Liquidity Sweep guide to learn SMC terminology, sweep identification, and Market Structure Shift trading.

4. Order Flow Delta

Best for: Seeing buying versus selling pressure in real-time

Order Flow Delta tracks the difference between volume traded at the ask price (buying pressure) and volume traded at the bid price (selling pressure). This real-time metric reveals the underlying intent behind price movement. A rising price with negative delta suggests weak buying that may not sustain, while a falling price with positive delta indicates hidden buying that could trigger a reversal.

Professional traders have used order flow analysis for decades, but only recently have these tools become accessible to retail traders. Delta footprint charts, cumulative delta, and delta divergences provide insights impossible to obtain from price and traditional volume alone. The indicator requires tick-level data and works best on liquid futures contracts where the bid/ask attribution is meaningful.

- Ease of Use: Advanced - requires understanding of market microstructure

- Accuracy: Very High - based on actual market orders

- Customization: Excellent - multiple visualization modes and timeframes

Discover Order Flow analysis with our comprehensive guide covering delta calculation, footprint charts, and absorption detection.

5. Candle Math

Best for: Quantifying candlestick patterns with objective metrics

Candle Math eliminates the subjectivity from candlestick analysis by measuring precise body-to-wick ratios, candle momentum, and pattern strength. Rather than guessing whether a pin bar is significant, Candle Math provides numerical scores that quantify the pattern quality. This objectivity is essential for algorithmic trading and for traders who want consistent pattern identification.

The indicator calculates body percentage (how much of the candle range is body versus wick), upper and lower wick ratios, and candle-over-candle momentum. These metrics filter out weak patterns and highlight high-probability setups. Combined with volume confirmation, Candle Math patterns offer actionable entry signals with clear invalidation levels.

- Ease of Use: Easy - numerical output is straightforward to interpret

- Accuracy: Good - removes subjectivity from pattern recognition

- Customization: Good - threshold values for pattern identification

Learn Candle Math calculations including body percentage formulas, wick ratios, and working NinjaScript code.

Professional Indicator Suite

Get all 10 indicators in one optimized package with advanced features, multi-timeframe analysis, and priority support.

6. VWAP (Volume Weighted Average Price)

Best for: Intraday fair value and institutional benchmarking

VWAP represents the average price weighted by volume for the trading session, serving as the benchmark institutional traders use to evaluate their execution quality. When price trades above VWAP, buyers are paying above fair value. When below, sellers are accepting below fair value. This simple concept provides powerful context for every trade decision.

Advanced VWAP implementations include standard deviation bands that identify overbought and oversold conditions relative to the session average. Anchored VWAP allows traders to calculate volume-weighted average from any significant point, such as earnings announcements, gap openings, or swing highs and lows. Multiple VWAP anchors reveal where different participant groups have their average cost basis.

- Ease of Use: Easy - intuitive above/below interpretation

- Accuracy: High - based on actual volume and price data

- Customization: Good - standard dev bands and anchor points

VWAP is included in NinjaTrader 8 by default. Our upcoming detailed guide will cover advanced anchoring techniques and VWAP band trading strategies.

7. Market Internals (TICK, ADD, VOLD)

Best for: Gauging overall market health and breadth

Market Internals track breadth indicators across the entire market, providing context that individual instrument analysis cannot. The NYSE TICK shows how many stocks are trading on upticks versus downticks at any moment. ADD (Advance/Decline) tracks the cumulative balance of rising versus falling stocks. VOLD compares volume in advancing issues to declining issues.

Index futures traders rely heavily on market internals to confirm or contradict price action in ES, NQ, and other broad market instruments. An S&P 500 rally with deteriorating breadth often fails. A pullback with strong internals often presents buying opportunities. These indicators separate real moves from head fakes and provide early warning of trend exhaustion.

- Ease of Use: Moderate - requires understanding of breadth concepts

- Accuracy: High - real-time measure of market participation

- Customization: Limited - standard calculations with display options

Market Internals require data feeds for NYSE TICK, ADD, and VOLD symbols. Our upcoming guide will explain setup and interpretation for different market conditions.

8. Supertrend

Best for: Clear trend direction with trailing stop levels

Supertrend combines Average True Range (ATR) volatility with price action to provide clear trend direction signals. When the indicator is below price (green), the trend is bullish. When above price (red), the trend is bearish. The indicator line itself serves as a dynamic trailing stop level, making trade management straightforward.

What sets Supertrend apart from other trend indicators is its adaptability to market volatility. In calm markets, the trailing stop tightens. In volatile conditions, it gives price room to breathe. This ATR-based adjustment prevents premature stop-outs while still protecting profits. The indicator works across timeframes from 1-minute scalping to daily swing trading.

- Ease of Use: Very Easy - color-coded with clear signals

- Accuracy: Good - performs well in trending markets

- Customization: Good - ATR period and multiplier adjustments

Supertrend is available as a free indicator for NinjaTrader 8 from multiple sources. It serves as an excellent starting point for traders new to trend-following systems.

9. ATR (Average True Range)

Best for: Position sizing and stop-loss placement

Average True Range measures market volatility by calculating the average of true ranges over a specified period. True range accounts for gaps by including the previous close in the calculation, providing a more accurate volatility measure than simple high-low range. While ATR does not indicate direction, it is essential for proper risk management.

Professional traders use ATR to size positions appropriately for current market conditions and to set stops that respect normal market noise. A stop placed 2 ATR from entry has a statistically lower chance of getting hit by random volatility. ATR-based position sizing ensures you risk the same dollar amount regardless of whether you trade a volatile instrument like NQ or a calmer one like bonds.

- Ease of Use: Easy - simple volatility measure

- Accuracy: High - objective measurement of recent volatility

- Customization: Simple - period length is the main parameter

ATR is built into NinjaTrader 8. Every serious trader should understand ATR-based position sizing regardless of their strategy or indicator preferences.

10. RSI/Stochastic Variations

Best for: Momentum confirmation and divergence detection

Enhanced RSI and Stochastic indicators go beyond the basic overbought/oversold readings that fail in trending markets. Modern variations include the Stochastic RSI (which applies stochastic calculations to RSI values for increased sensitivity), RSI with divergence detection, and multi-timeframe RSI panels that show momentum alignment across periods.

The real power of oscillators lies in divergence analysis. When price makes a new high but RSI fails to confirm, the advance is weakening. Hidden divergences, where price makes a higher low but RSI makes a lower low, often precede trend continuations. Automated divergence detection eliminates the need to manually identify these patterns, alerting you to potential reversals before they occur.

- Ease of Use: Moderate - divergence concepts require study

- Accuracy: Good when used for confirmation, not primary signals

- Customization: Excellent - many period and smoothing options

Basic RSI and Stochastic are included in NinjaTrader 8. Enhanced versions with divergence detection and multi-timeframe features are available from third-party developers.

Indicator Comparison Table

Use this comparison table to quickly assess which indicators match your trading needs and experience level.

| Indicator | Type | Difficulty | Best For | Price |

|---|---|---|---|---|

| Volume Profile | Volume Analysis | Intermediate | Support/Resistance | Free & Premium |

| Harmonic Patterns | Pattern Recognition | Advanced | Reversal Trading | Free & Premium |

| Liquidity Sweep | Smart Money | Beginner | Stop Hunt Detection | Free & Premium |

| Order Flow Delta | Order Flow | Advanced | Pressure Analysis | Premium |

| Candle Math | Candlestick | Beginner | Pattern Scoring | Free & Premium |

| VWAP | Volume Analysis | Beginner | Fair Value | Built-in |

| Market Internals | Breadth | Intermediate | Market Health | Free (data req.) |

| Supertrend | Trend Following | Beginner | Trend Direction | Free |

| ATR | Volatility | Beginner | Risk Management | Built-in |

| RSI/Stochastic | Momentum | Intermediate | Divergences | Built-in & Premium |

How to Choose the Right Indicators for Your Trading Style

The best indicator setup depends on your trading timeframe, risk tolerance, and preferred market approach. Here are recommendations based on common trading styles.

For Day Traders

Day traders need real-time information and quick decision support. Build your foundation with Volume Profile for session-based support and resistance, Order Flow Delta for pressure analysis on entries, and VWAP for intraday fair value context. Add Market Internals if you trade index futures, as breadth divergences often precede turns in ES and NQ. Avoid lagging indicators that provide signals after the move has already happened.

Consider a primary screen with price, Volume Profile, and VWAP. A secondary screen can display Order Flow footprint charts and Market Internals. This setup provides institutional-grade analysis without information overload.

For Swing Traders

Swing traders holding positions for days to weeks benefit from indicators that identify structural levels and pattern completions. Composite Volume Profile reveals where multi-day accumulation occurred. Harmonic Patterns identify reversal zones for mean-reversion entries. Supertrend provides clear trend direction and trailing stop levels for position management.

Use ATR-based position sizing to normalize risk across different instruments and market conditions. RSI divergences on daily charts can signal momentum exhaustion before trend reversals, giving you early warning to tighten stops or take partial profits.

For Beginners

New traders should resist the temptation to add multiple indicators immediately. Start with ATR for proper risk management, as no indicator will save you from poor position sizing. Add VWAP to understand intraday context. Once comfortable, introduce Volume Profile to learn where significant activity occurs.

Avoid advanced tools like Order Flow Delta until you understand basic market structure. Liquidity Sweep concepts are valuable to learn early, as they explain why obvious levels often fail. Master one indicator thoroughly before adding the next.

For Advanced Traders

Experienced traders can combine multiple confirmation signals without creating analysis paralysis. Order Flow Delta confirming Volume Profile levels creates high-conviction entries. Harmonic pattern completions at composite POC levels represent exceptional risk/reward opportunities. Liquidity sweeps that coincide with Market Internal extremes often mark significant reversals.

The key is defining specific setups where indicators align rather than requiring every indicator to confirm every trade. Document your indicator combinations and their win rates to identify which confluences provide the best edge.

Getting Started

The ten indicators in this guide represent the best tools available for NinjaTrader 8 traders in 2026. From volume-based institutional analysis to pattern recognition and momentum studies, these tools cover every aspect of technical analysis. The key is not to use them all simultaneously but to select the ones that match your trading style and master them thoroughly.

Start by exploring the detailed guides for the indicators that interest you most. Our Volume Profile guide, Harmonic Patterns guide, Liquidity Sweep guide, Order Flow guide, and Candle Math guide provide setup instructions, trading strategies, and NinjaScript code samples.

For professional-grade versions of these indicators with advanced features, multi-timeframe analysis, and dedicated support, visit AlgoGemix. Whether you choose free or premium tools, commit to learning them properly and your trading will improve.